nj application for tax clearance certificate instructions

New jerseys online annual reports and change services. Top Credit Union In Illinois Top 10 Credit Unions Top Credit Unions In Ohio.

Form A 5088 Tc Download Fillable Pdf Or Fill Online Application For Tax Clearance Certificate New Jersey Templateroller

Certificates may be requested through the State of New Jerseys Premier Business Services PBS portal online.

. Agency Contact Phone - 732-218-3400. Make sure the corporate name is spelled correctly. Tax Clearance Certificates are valid for 180 days.

Nj tax clearance certificate onlinee certificatees like smartphones and tablets are in fact a ready business alternative to desktop and laptop computers. Even a slight misspelling will generally make it difficult to identify the corporation for which the application is made. Agency Contact Address - 900 Route 9 North Suite 404 Woodbridge NJ 07095.

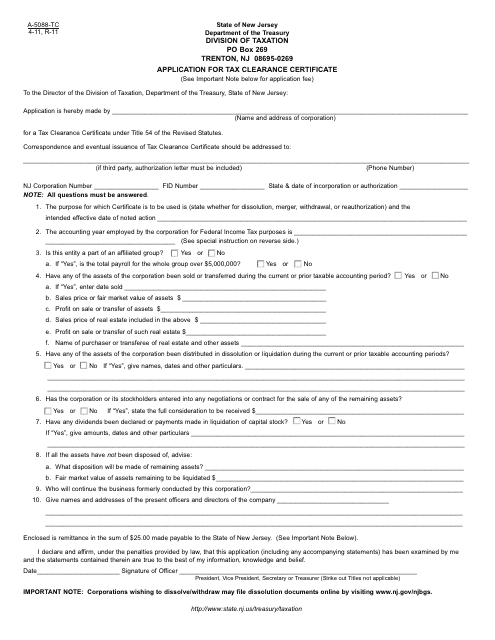

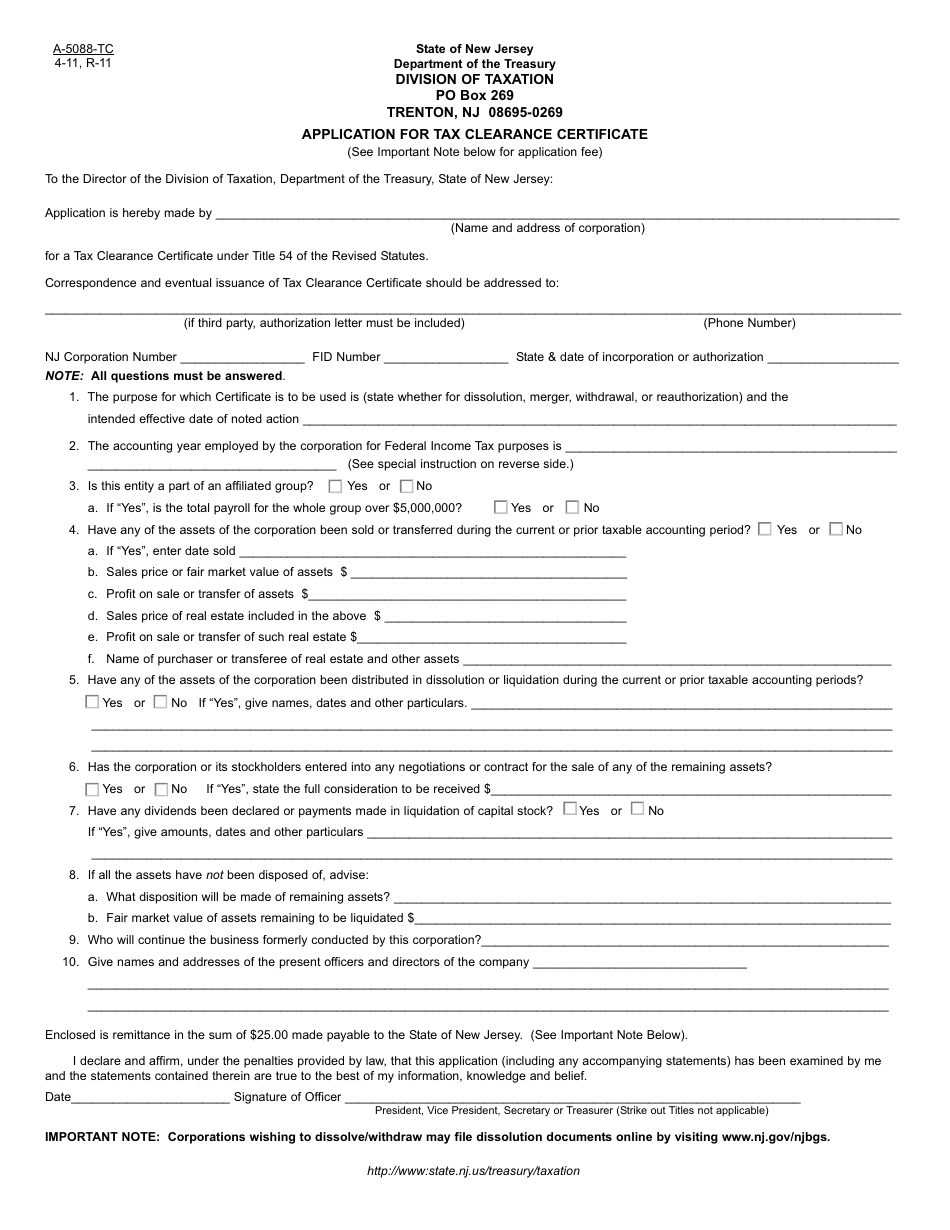

APPLICATION FOR TAX CLEARANCE CERTIFICATE Prepare and remit with 2500 fee A-5088-TC 8-99 R-8 To the Director of the Division of Taxation Department of the Treasury State of New Jersey. Under the Tax Revenue Center select Tax Services then select Business Incentive Tax Clearance. Offer helpful instructions and related details about Tax Clearance Certificate Nj - make it easier for users to find business information than ever.

You can take them everywhere and even use them while on the go as long as you have a stable connection to the internet. TRC does not accept Tax Clearance Applications. After July 1 2017 any applicant for certification that cant obtain a Premier Business Services.

TRC does not accept Tax Clearance Applications. If expired follow the instructions via the online portal to re-issue. The licensee must file a renewal application renewal fee and proof of new jersey sales tax clearance on or before july 30 each year.

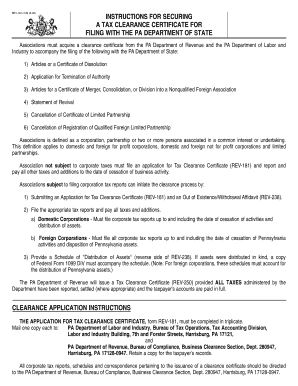

Instructions for filing tax returns can be found on the form Procedure for Dissolution Withdrawal or Surrender. The corporation must pay 120 of which 95 is a dissolution fee and 25 is a tax clearance certificate application fee. REV 31 0037 71414 Revenue Clearance Certificate Application.

New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation. Once it has been determined to shut down a New Jersey corporation. Entities required to file corporation tax reportsmay initiate the tax clearance process by.

Clearance certificates which are issued by the new jersey division of taxation. Tax returns and has not paid all tax penalties interest or fees due the Director shall issue a notice to the applicant of the particulars to be resolved before a tax clearance certificate may be issued. Application for Tax Clearance - New Jersey.

Agency Contact Address - CLEAResult 75 Lincoln Highway Suite 100 Iselin NJ 08830. It is commonly requested by the taxpayers or businesses used as a verification to the investors or clients that the business is tax compliant or of good standing. Tax clearance is required for all for-profit corporations to end their business in the State of New Jersey.

If expired follow the instructions via the online portal to re-issue. Be sure to include the State and date of incorporation or date of authorization. Entity in New Jersey.

1 Submitting an Application for Tax Clearance Certificate REV-181. The application for Tax clearance will be submitted to the Division of Taxation electronically. Agency Contact Phone - 732-855-0033.

Application Number - As assigned by the Program. A-5088-TC 4-11 R-11 State of New Jersey Department of the Treasury DIVISION OF TAXATION PO Box 269 TRENTON NJ 08695-0269 APPLICATION FOR TAX CLEARANCE CERTIFICATE See Important Note below for application fee To the Director of the Division of Taxation Department of the Treasury State. All others must submit their applications through the Premier Business Services Portal.

Ad Download Or Email Form GTB-10 More Fillable Forms Register and Subscribe Now. 2 Filing the appropriate tax reportsreturns and paying all taxes interest and penalties. All Tax Clearance Applications must be completed via the Division of Taxation online Premier Business Services Portal.

Application is hereby made by _____ Name and address of corporation. Questions about the award process should be directed to the issuing State Agency noted on page 1. Also list the date of execution signature.

Exhibit 1 NJ Tax Clearance Certificate Instructions for obtaining this are below. Business Tax Clearance Certification Required for Receiving State Grants Incentives. CLEAResult does not accept Tax Clearance Applications.

Instructions for Completing Form A-5052 item 3. Ad Download Or Email NJ A-5052-TC More Fillable Forms Register and Subscribe Now. Nj form a-5088-tc instructions.

Questions about the tax clearance process may be directed to. New Jersey Division of Taxation Tax Clearance Unit PO Box 277 Trenton New Jersey 08695. There is a 2500 fee that is to be submitted with each Application for the Tax Clearance Certificate Form A-5088-TC.

8 See Form A-5033-TC Step 1. It certifies that a business or individual has met their tax obligations as of a certain date. Ad Download Or Email Form GTB-10 More Fillable Forms Register and Subscribe Now.

Application for certificate of a tax clearance certificate. EXECUTION SignatureDate Have the chairman president or vice-president of the each business entity sign. After July 1 2017 any applicant for certification that cannot obtain a Premier Business Services account may submit a paper application Gtb-10 for business assistance tax clearance.

If expired follow the instructions via the online portal to re-issue. Second the corporation must submit a Form A-5088-TC. Application for Tax Clearance Certificate must be typewritten or printed and should be addressed to.

Division of Taxation Tax Clearance Certificate required. Application Number - As assigned by the Program. Withdra w al or Dissolution of a Corp oration and G uaranty.

A Tax Clearance is an official document issued by the Bureau of Internal Revenue BIR in the Philippines. . Tax Clearance Certificates are valid for 180 days.

Tax Clearance Certificates are valid for 180 days. Application for Tax Clearance and Instructions. Please note that the issuance of the Tax Clearance Certificate is a lengthy process and may take several months.

Application Number - As assigned by the Program. Under the tax revenue center select tax services then select business incentive tax clearance. Application for Tax Clearance Certificate must be typed or printed.

Form A 5088 Tc Application For Tax Clearance And Instructions

Form A 5088 Tc Application For Tax Clearance And Instructions

Form A 5088 Tc Download Fillable Pdf Or Fill Online Application For Tax Clearance Certificate New Jersey Templateroller

Instructions T O Fill Up The Common Application Forms Ap Online

Rev 181 Instructions Fill Online Printable Fillable Blank Pdffiller

Jury Duty Via Zoom Instructions City Of Seatac

Tax Clearance Certificate Sample Fill And Sign Printable Template Online Us Legal Forms

Form A 5088 Tc Download Fillable Pdf Or Fill Online Application For Tax Clearance Certificate New Jersey Templateroller

Learn How Acist Medical Systems Helps Interventional Cardiologists Acist Medical